More billionaires are turning to luxury real estate as the gold standard investment, but what if I told you their choices are far from the typical glitzy urban centers?

In 2025, this trend is catching fire like never before, driven by geopolitical shifts and the evolving climate crisis; understanding these choices could redefine your investment strategies.

It's not just Monaco and Beverly Hills luring the super-rich. The hottest properties are now nestled in serene locations with potential for seismic growth. Picture this: Iceland has become a hub of interest. Yes, Iceland! Its sparse population, renewable resources, and exquisite untainted landscapes are drawing billionaires willing to pay a premium for future-proof living. But that’s not even the wildest part…

These investments are often not publicized — a secretive shuffle amongst the world’s wealthiest. They’re leveraging low-tax havens to manage costs and maximize returns. The market sentiment suggests accessible luxury properties are scarce, triggering bidding wars and skyrocketing prices. You might wonder, how could such secretive buying influence global markets? But what happens next shocked even the experts…

As climate change becomes a pressing concern, billionaires are snatching up eco-friendly properties. These homes offer more than luxury; they promise sustainability in uncertain times. With rising eco-consciousness, buyers now factor in carbon footprints alongside their desire for opulence. It's not just about living large anymore; it's about living responsibly. Solar-powered mansions with innovative energy solutions are becoming increasingly desirable. What you read next might change how you see elite real estate forever.

For these investors, it's more about securing a future than mere profit. The countries drawing this new breed of eco-billionaires are those with strong environmental laws and untapped green potential. Places like Costa Rica offer high-end properties with access to lush rainforests while supporting sustainable practices. What does this mean for traditional property hotspots? But there’s one more twist waiting…

These remote locations often come with unique challenges such as accessibility and infrastructure. But the savvy investors are recognizing these as opportunities, investing in private airstrips and local developments to keep these paradises connected yet exclusive. But another shockwave is sweeping the industry…

The luxury market is experiencing a shift. Mainstream markets are reevaluating strategies to accommodate the ripple effect of these eco-friendly paradises. Could this be the beginning of the end for high-rise condo investments? The story doesn’t end here; find out what’s sparking this transformation next.

2025 is setting the stage for a major upheaval in investment dynamics. Forget London and New York; billionaires are discreetly buying properties in less-raveled urban hubs. These cities offer unrivaled privacy and potential for growth. Nantes in France, for instance, is seeing an uptick in purchases due to its burgeoning tech scene and serene yet accessible location. Known as the next Silicon Valley, it offers investment stability seasoned with cultural flourishes. If you think the traditional lux hubs are irreplaceable, think again.

Part of the allure is the recognition of yet-untapped potential these urban hideaways hold. They promise diversification and exposure to emerging markets without the monumental costs of maintaining properties in traditionally expensive cities. Skeptics are yet to realize the massive societal and economic impacts ahead. But there’s one more compelling reason behind these investments.

Investors are also betting on lesser-known cities due to their remarkable resilience during financial downturns. These locations thrive quietly, offering safety nets against market volatility. The quiet yet bustling real estate scenes attract not just billionaires, but also visionary entrepreneurs. But expertise advises caution as there's complexity in managing overseas investments.

Managing properties in these off-the-beaten-path locations comes with its unique set of challenges like unregulated real estate practices and varied taxation policies. But for those willing to navigate through the red tape, the rewards are extraordinary. So what's the real game-changer in this developing trend? Let's dive deeper to uncover more.

With tech giants expanding their reach, seemingly nondescript locations are turning into tech powerhouses. Cities like Austin, Texas, and Bangalore, India, have caught the eyes of billionaire investors seeking to capitalize on the tech boom. Real estate there offers the combination of high returns and the potential synergy with tech ventures. Are we seeing tech influence exploding beyond expected frontiers?

Austin, often called the Silicon Hills, boasts robust infrastructure and a culture of innovation. The rise of remote work means that tech professionals are clustering in areas where it's more affordable to lay down roots, thereby driving up the demand for high-end residences. Will the billionaire influx redefine tech hub real estate in previously unforeseen ways?

On the other hand, Bangalore, often referred to as the Silicon Valley of India, offers astonishing price advantages compared to Western tech centers. Investors benefit not only from booming real estate but also from the opportunity to diversify their portfolios in high-growth markets. There's more to the story about what tech advancement means for futuristic urban living.

These markets face pressures such as inadequate infrastructure to support the next wave of wealth infusions. Yet, plans for expansion and upgrades are well underway, promising to accommodate the growing demand. Investors, beware of fragmentation—some parts are growing too fast for their infrastructure to catch up. What does this spell for the tech cities of tomorrow? Discover the next shift.

In 2025, privacy is key, more than ever, and luxury village retreats offer that in abundance. From the Tuscan countryside to the secluded beaches of Thailand, wealthy buyers are investing in large estates that double as private sanctuaries. But what does this retreat phenomenon say about public life at the top?

These enclaves provide peace away from prying eyes and offer unparalleled comfort. Some estates come with dedicated service staff ensuring both relaxation and security. It's an escape from the frenzied urban scene into a controlled environment that is both familiar and rejuvenating. Is this the billionaire's antidote to burnout?

Oddly enough, these luxury investments aren’t always straightforward purchases. Some of the wealthiest buyers finance developments in these remote sanctuaries, bringing new revenue streams through luxury vacation rentals. The twist lies in the investment return from seasonal rentals, offsetting initial costs and creating a passive income flow. But what's the ripple effect of such hidden transactions?

The allure of exclusivity poses an environmental challenge as the real estate developments impact local biodiversity. Conscious billionaires are increasingly emphasizing eco-friendly practices in their developments, reflecting a synergy between luxury and sustainability. Will the new models redefine luxury real estate norms? Follow the reveal as our narrative unfolds.

Stunning luxury properties aren't just about expansive square footage anymore. The trend is moving towards uniquely designed, avant-garde architectural marvels. These properties represent more than taste; they're statements of philosophy. How are these architectural wonders reshaping the billionaire's world view?

Incorporating art into architecture, these luxury mansions now serve dual purposes: homes and art installations. The rise of art-inspired real estate speaks volumes about the impact of cultural investment in personal spaces. But what happens when these bold designs clash with traditional expectations in real estate?

Architectural innovation has led to the creation of smart homes with integrated tech features rivaling the convenience of sci-fi futures. Biometric security, personalized environmental controls, and AI-driven amenities are pushing the envelope. The high-tech touch is giving residents unprecedented control and safety. Could this be the next step in redefining luxury living?

While these high-concept designs wow the modern elite, they're often disruptive, challenging local architectural norms. This has sparked debates about cultural preservation versus modern innovation. Yet, the creative marriage between art and real estate continues to flourish. But there's still an untold story about the billionaires’ favorite architectural trends and their future developments.

As investments in luxury real estate soar, tax incentives increasingly influence investor decisions. Various countries are tempting billionaires with alluring tax policies. Looking to ensure robust growth, these governments offer reduced property taxes, no capital gains tax, and fast-track visa programs. Is the tax landscape tilting the scales in 2025?

The Cayman Islands, for example, known for tax neutrality, continue to lure investors with the promise of financial privacy and advantageous tax regimes. Tax breaks here are a powerful draw for those seeking to secure wealth across international borders. But what’s the hidden catch in these enticing arrangements?

Such policies are fostering competitiveness among nations, turning them into magnets for the rich. Portugal's Golden Visa scheme offers residency to property investors, opening doors to EU privileges while keeping tax liabilities low. But these policies are double-edged swords that could alter local economies profoundly.

These tax havens are seducing billionaires at a fast clip, but experts caution about regulatory changes leading to either rapid gains or devastating losses. As they navigate these lucrative but volatile territories, could this strategy inadvertently trigger global economic shifts? Stay with us to unlock the next revelation.

Health-conscious billionaires are clamoring for properties that offer all-inclusive wellness experiences. These retreats focus on physical and mental well-being, offering not just a home but a holistic lifestyle. Who wouldn’t be tempted to buy into a life of luxury curated around rejuvenation?

Nestled in pristine locations, these retreats provide panoramic views while ensuring access to spas, personal trainers, and organic cuisine. They cater to a rising demand for wellness amongst the uber-wealthy, tapping into health trends with affluent flair. Yet are these indulgences sustainable in the long term?

Innovations in the wellness industry are seamlessly integrating into luxury real estate, where features like zen gardens and thermal pools maximize health benefits. The wellness real estate sector is expected to grow significantly, capturing the spirit of immersive and elaborate self-care at the heart of these lavish estates.

Despite the overwhelming allure, maintaining top-tier wellness standards can be challenging, demanding constant investment to keep facilities state-of-the-art. But there's a catch—the more exclusive the services, the higher the maintenance and risk. Could this rise in wellness investment redefine personal luxury forever? Find out now.

The intersection of real estate and cryptocurrencies is piquing billionaire interest. With digital currencies gaining acceptance as transactional assets, some property purchases are now conducted entirely in Bitcoin or Ethereum. How does the crypto revolution impact luxury real estate?

Cryptocurrency offers anonymity and decentralization, appealing to those wary of traditional financial scrutiny. High-end properties now list prices in crypto, fueling both intrigue and skepticism. But how secure are these transactions, and what does this mean for property ownership?

While crypto is speculative by nature, the blend with real estate suggests a futuristic trend. Early adopters gain substantial leverage with crypto's potential appreciation. Yet the volatility demands seasoned insight to maximize benefits and avert potential losses. What are the legal challenges in owning virtual currencies tied to real estate?

The friction between crypto and real estate involves regulatory gray areas. While some nations embrace digital currencies, others resist, creating a convoluted compliance landscape. The rise in crypto-fueled purchases is shaping new financial paradigms, ripe with opportunity and peril. Stay tuned for the unfolding implications of this digital shift.

A resurgence in resort-style living marks 2025’s luxury real estate trends. These investments offer unparalleled recreation and relaxation facilities. High-profile resorts are seeing an influx of private investment, enticing billionaires with promises of exclusive access. Could this be luxury's ultimate answer to paradise?

Resort-style estates deliver experiences beyond standard homes. From golf courses to gourmet dining, they encompass a universe of leisure activities tailored for affluent tastes. But is this resort boom sustainable with current market dynamics?

These investment opportunities promise dual returns: personal enjoyment and potential financial gains through shared ownerships or leasing arrangements. However, they face challenges in maximizing occupancy during off-seasons and economic downturns. The secret lies in strategic investment planning, yet there's an overlooked nuance in this sector.

Such lavish estates must adapt to shifting trends and client expectations, requiring constant innovation. The integration of eco-friendly practices into resort operations adds value while preserving natural beauty. Have billionaires uncovered a foolproof investment forward? Continue reading as we delve into potential pitfalls and profitability.

Billionaires often clash with local regulations when snapping up prime properties. Zoning laws control the landscape, frequently creating roadblocks for massive projects that deviate from standard uses. What’s at stake in this battle of vision versus regulation?

Compliance with stringent zoning laws can be a convoluted process, causing delays and driving up costs. However, savvy investors are finding creative ways to work with officials to reshape landscapes. How do zoning rulings become facilitators or detractors of luxury progress?

Real estate moguls must navigate local complexities while maintaining leverage. New zoning directives can amplify a property's value but also introduce bureaucratic nightmares. Potential pitfalls include restrictive assessments that drastically limit potential usage. Should investors be warier about regulatory landscapes than market trends?

Failure to adhere to zoning regulations can lead to hefty fines and project shutdowns, spiraling costs even further. Yet, overcoming these hurdles can pave the way for groundbreaking luxury projects. The chaos of zoning laws embarks property investors on unpredictable adventures. What’s the next chapter in this regulatory conquest?

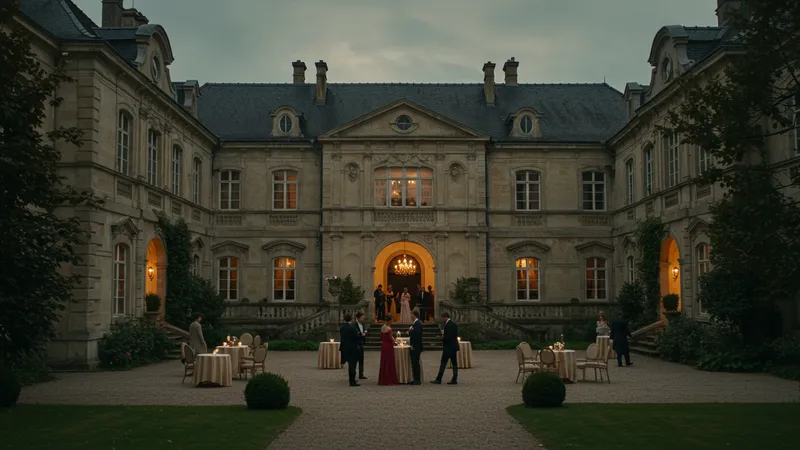

Reviving historical estates to their former glory is more than a passion project—it's turning into a sophisticated investment strategy. These ventures often blend opulence with prestige. Are historic properties experiencing a renaissance in luxury circles?

Investors are funding restorations of age-old properties, returning architectural gems to their prominence while enhancing market appeal. These relics offer a unique blend of history and luxury, allowing homeowners to bask in bygone elegance. Beyond the price tags, how do these treasures contribute to cultural preservation?

The task of transforming ancient estates into contemporary luxury is daunting. Meticulous refurbishments are costly and time-consuming, demanding extensive research and craftsmanship. The delicate dance of maintaining authenticity while modernizing can make—or break—a property's market standing. What are the financial risks and rewards of this heritage investment?

The allure of historical properties invites challenges, from structural instabilities to inflexible heritage laws. Despite these, the payoff can be monumental. Such restorations signify prestige and uniqueness, attracting discerning buyers. Yet the deeper complexities must be unraveled. Can they withstand the weight of modern luxury demands? Follow as we continue to explore.

As globalization interlaces with real estate, cultural investments are rising. Billionaires are vying for properties that blend local aesthetics with luxury, creating cross-cultural synergy. This phenomenon is reshaping luxury real estate. What draws ultra-wealthy investors to cross-cultural homes?

Cultivating cross-cultural designs allows properties to stand out in a crowded market. By intertwining diverse architectural styles and traditions, these homes offer unparalleled allure and depth. Imagine owning a villa that melds Mediterranean grandeur with the minimalism of Japanese zen gardens. Will this trend define the future of global luxury investments?

Intricate as it is, blending cultural elements requires expertise and sensitivity to maintain integrity. The ability to repurpose exotic designs into market trends speaks volumes about one's investment acumen. However, uncertain economic climates threaten to obscure these culturally rich ventures. Are they more than a fad or serious hedge against market volatility?

Ensuring seamless fusion and respecting cultural touchstones is paramount. Disjointed execution alienates potential buyers seeking cohesion. Those venturing into this fusion frontier must be prepared for cultural as well as financial challenges. Ensemble creations might just redefine the echelon of luxury, or falter in the face of tradition. Discover what this means for the trailblazers of tomorrow.

Luxury real estate in 2025 is a world full of unexpected twists and innovations. From eco-friendly havens to tax-induced travel, each investment holds a promise and a pitfall. The wealthy are not just buying homes; they're crafting legacies. With ever-shifting sands, following these trends is not just fascinating; it's essential. Stay ahead in this opulent game and influence your own estate strategies by embracing these insights.

Engage with us further, share this compelling expedition of billionaire habits, and arm yourself with the knowledge to navigate this luxurious territory. Let the curiosity linger, bookmark this page, and unleash your ambitions. The journey continues—for those daring enough to redefine the world of high-stakes real estate.