The growing importance of health insurance is transforming the way individuals approach personal wellness and financial security. More people are seeking insurance to protect themselves against unexpected medical expenses, reflecting shifts in both societal priorities and the global economic landscape. This phenomenon is not just about buying a policy—it represents a fundamental change in how consumers value preparation, peace of mind, and long-term planning for healthcare costs.

Many factors contribute to the increased focus on health insurance. Rising medical costs, greater awareness of health risks, and evolving legislative frameworks all play roles in the surge of demand. Consumers now analyze coverage options with more scrutiny, comparing premium costs, benefits, and levels of support. This intricate decision-making process is driving innovation and competition within the insurance industry, leading to a range of products that are increasingly tailored to individual preferences and demographic shifts.

The variety of health insurance products continues to grow. Insurers often differentiate through specialized coverage advantages, wellness incentives, and additional tech-driven features. Consumers can now prioritize convenience and personalized care, choosing policies that address their unique medical and lifestyle needs. This rise in diversity of choices creates both opportunities and challenges as individuals navigate policy details and compare overall value.

Technological advancements are also reshaping the health insurance experience. Digital health records, app-based plan management, and streamlined support services contribute to better customer experiences and more efficient care coordination. As demand rises, insurers are incentivized to adopt user-friendly interfaces and proactive engagement—further enhancing transparency for policyholders.

Interestingly, growing awareness among younger age groups and those with chronic conditions has led to broader uptake of policies that emphasize preventive care and long-term coverage. This not only affects individual wellness outcomes but also influences market trends in pricing, risk sharing, and plan flexibility, highlighting a consumer base that is increasingly well-informed and selective.

In many markets, health insurance providers are re-imagining their role from passive payers to active partners in health. As a result, consumers find themselves empowered but also tasked with the responsibility to stay educated and critical of their coverage decisions. The deeper details reveal even more valuable insights ahead, especially when digging into how coverage, cost structures, and user experiences shape everyday decisions for policyholders.

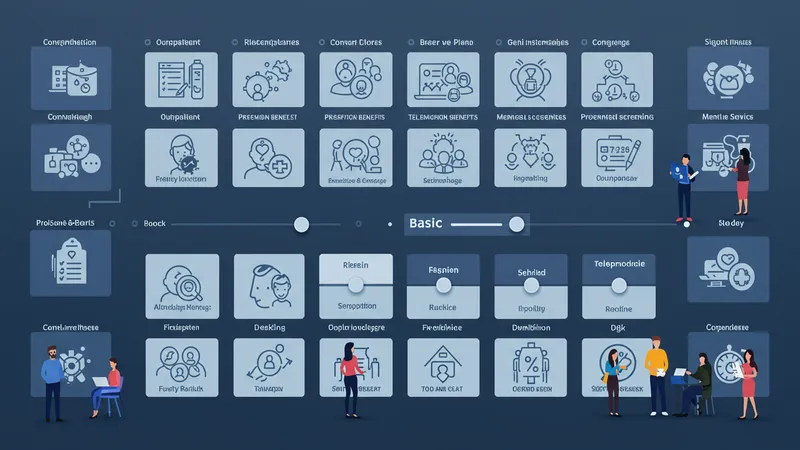

When exploring health insurance options, consumers place significant emphasis on the features offered by each plan. These may include outpatient and inpatient coverage, prescription benefits, telemedicine, mental health services, and preventive screenings. As the demand for health insurance grows, the divergence between basic and comprehensive plans becomes more noticeable, driving individuals to carefully weigh what they actually need versus what may be extraneous.

Plan flexibility is now a prominent selling point. Many leading insurers offer highly customizable policies, allowing policyholders to select only the coverages that fit their health situation. This rise in demand coincides with a broader trend toward more personalized healthcare and the need for plans that reflect an individual’s medical history, age, and chronic conditions. The move toward modular coverage structures directly benefits consumers by allowing better alignment with their preferences and budgets.

Another important feature shaping consumer choices is network access. As plan providers compete in this growing market, they build larger, more diverse networks of hospitals, clinics, and specialists to attract policyholders. Broad network coverage increases convenience and choice, especially for those with specialized medical needs or those who frequently travel. Access to global health networks has become especially significant for expats and people residing in multiple locations.

The inclusion of technology in plan features is increasingly influential. User portals, mobile apps, telehealth consults, and even integration with wearable devices offer greater engagement and insight into policy use. Consumers gravitate toward insurers that provide these innovations, seeking ongoing support, real-time claims tracking, and seamless communication—features that align with a modern, digital-first lifestyle. These competitive differentiators have turned technology into a key factor in the rise of health insurance demand.

The rising demand for health insurance has heightened the importance of transparent pricing structures. Consumers are now more alert to the true costs behind premiums, deductibles, out-of-pocket maximums, and copayments. Clear communication of these components empowers buyers to make informed decisions, compare plans side by side, and avoid unexpected expenses that can strain household budgets.

Some insurers are addressing affordability through tiered plans and subsidies for eligible individuals. Entry-level policies provide basic coverage at lower costs, making insurance accessible to a wider audience. At the same time, more comprehensive plans allow consumers to secure higher levels of care for a bigger investment. This stratification helps both first-time buyers and seasoned policyholders find suitable options without sacrificing critical health protection.

As demand grows, the industry also sees increased advocacy for regulatory oversight to ensure ethical pricing. Consumer watchdog organizations and policy analysts closely monitor rate increases and policy changes, fostering trust in the insurance system. Such measures can drive market competition, keeping premiums within reach for various economic brackets, and promoting a sustainable balance between insurer profitability and consumer value.

Affordability is further influenced by wellness benefits included in many modern plans. Discounts for healthy behaviors, fitness tracking, and preventive checkups have become standard offerings, aligning the financial interests of both insurers and policyholders. These features serve as incentives for maintaining healthier lifestyles while lowering long-term healthcare costs, contributing to the ongoing surge in insurance uptake and satisfaction.

Growing demand for health insurance has put a spotlight on the consumer experience across every touchpoint. From initial research and comparison to claims processing and day-to-day support, insurers are investing in user-centric services to attract and retain policyholders. Easy-to-navigate websites, responsive customer service, and clear plan explanations are now baseline expectations in the crowded insurance landscape.

Policyholders increasingly desire real-time updates regarding coverage and claims. Insurers are responding with mobile applications, text notifications, and web-based portals that offer transparency at every step. These technologies reduce stress for users and build confidence in both the insurer and the policy—critical factors as health insurance shifts from a luxury to a mainstream necessity.

Another area of rapid improvement is education. Insurers create guides and digital tools to help consumers understand fine print, tiered benefits, and exclusions. By boosting insurance literacy, providers not only win trust but also reduce confusion and frustration—common roadblocks to satisfaction in years past. This trend reflects a broader movement toward partnership between insurers and policyholders, rather than a transactional relationship.

Feedback mechanisms have also gained importance. From post-interaction surveys to in-app ratings, the consumer voice shapes service improvements and prompts quicker responses to individual needs. As engagement deepens and competition intensifies, those health insurers who excel at delivering positive, consistent experiences are poised to gain more traction in a rapidly expanding market.

The rising demand for health insurance is not just a short-term trend—its effects are already influencing wider healthcare landscapes and consumer behaviors. Individuals who secure adequate coverage tend to access healthcare services more proactively, investing in preventive measures and early treatments that lead to improved long-term wellness. This fundamental shift can result in reduced financial strain and more deliberate use of healthcare resources.

The increased uptake of insurance often encourages market innovation. Insurers continuously refine product offerings, from introducing new coverage types to launching customized, on-demand policies. These developments allow people to adapt their protection as life changes, such as family growth or the onset of chronic conditions. In turn, consumers benefit from greater flexibility and resilience in facing future uncertainties.

A wider base of insured individuals can also drive systemic improvements in healthcare infrastructure. As more people contribute to insurance pools, economies of scale may support lower administrative costs and enhance providers’ ability to coordinate care efficiently. The collective emphasis on insurance encourages healthcare providers and payers alike to optimize their service delivery in ways that foster better outcomes for all involved.

Finally, growing demand for health insurance is reshaping cultural attitudes about personal responsibility and collective welfare. People are more aware of their role in managing health expenses and less likely to postpone or skip necessary treatment. This evolving outlook not only fortifies individual security but also reinforces the societal safety net—a change with enduring impact as the insurance landscape continues to evolve.