Imagine facing an unexpected hospital visit or sudden medical emergency—without protection, these events can become financially overwhelming. In Australia, the concept of health insurance goes beyond simply covering medical bills. It acts as a financial safety net, ensuring that you and your family can access quality healthcare services when you need them most, while protecting your long-term well-being and peace of mind. Rather than being a luxury, health insurance forms a critical pillar for safeguarding both your current health and your future security.

Health insurance in Australia typically works by sharing the costs of medical care between you and your insurer. This can include hospital stays, surgeries, dental treatments, mental health support, and prescription medications. Why is this so vital? Public healthcare, via Medicare, covers many essential services, but it comes with wait lists, limited provider choice, and gaps in coverage for specific treatments. Private health insurance fills those gaps—giving you faster access to care, more control over your treatment, and financial cushioning against surprising events.

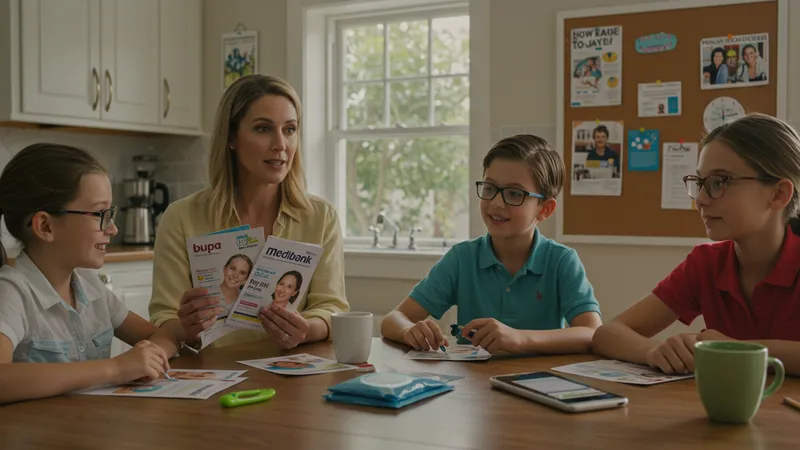

Comparing private health insurance options in Australia can feel complex—major insurers like Bupa, Medibank, and nib each provide a range of policies tailored to age, lifestyle, and family circumstances. For singles, couples, and families, choices often include varied levels of hospital and extras cover, offering customisable benefits. These can include dental, optical, physiotherapy, and alternative therapies. Policy flexibility is crucial, especially as life stages and health needs evolve.

Price is a major consideration, yet it’s often offset by the practical benefits. With average starting prices ranging from $22–$27 per week for essential cover, Australians can avoid large out-of-pocket expenses when health challenges arise. Furthermore, most private health insurance holders enjoy shorter wait times for elective surgeries and the ability to pick their preferred doctor or hospital. This freedom can make a substantial difference during stressful periods of treatment and recovery.

Perhaps most surprisingly, private health insurance isn’t only about accessing top specialists or private hospitals. Many policies, for example those from Bupa or Medibank, offer wellness benefits, support for chronic condition management, and even mental health resources. These add value far beyond emergency care—they empower policyholders to proactively care for their long-term health, aiming to prevent problems before they arise. The holistic approach to well-being is a vital differentiator.

In addition to personal peace of mind, private health insurance plays a strategic role in the broader Australian healthcare system. By alleviating pressure on public hospitals and sharing the funding load, it contributes to shorter public queues and a more sustainable Medicare. For consumers, this symbiotic relationship means greater resilience against changing health circumstances and unexpected costs. But how do you know which features suit you best, and what should be considered before choosing a policy? The deeper details reveal even more valuable insights ahead, as we explore specific benefits and decision points that matter most.

Australia’s health insurance market is divided primarily into two segments: hospital cover and extras cover. Hospital cover helps pay for inpatient treatments, accommodation costs, and operating theatre fees at private hospitals. Extras cover is all about ancillary benefits—it reimburses costs for out-of-hospital services like dental, optical, physiotherapy, and certain wellness programs. Many people opt for combined policies to gain broader protection and flexibility, especially when managing family needs or chronic conditions.

The distinction between cover types is important for policyholders to understand. For example, a Bupa Hospital & Extras policy might include extensive options for both hospital care and outpatient services—yet a Medibank Comprehensive Hospital and Extras package could bundle additional services such as childbirth or cardiac coverage. nib, meanwhile, positions its Family Health Insurance for those seeking solid value while balancing routine and emergency medical encounters. These differences matter when comparing policies based on individual or family priorities.

Policy structure is further influenced by government incentives, such as the private health insurance rebate (based on income) and the Lifetime Health Cover loading, which encourages younger people to take out cover earlier. Understanding these features helps residents select a plan with the right mix of affordability and long-term benefit, rather than just focusing on premium cost alone. Savvy Australians leverage these rules to minimise their expenses and maximise claimable benefits.

Regional considerations may also influence your choice. In some states, certain extras are in higher demand thanks to local health trends or provider availability. Comparing inclusions and limits for items such as orthodontics, mental health services, or preventive screenings is a crucial step. Policies from companies like nib might offer bonus resources for families with young children, while Bupa highlights preventative health and chronic disease management, illustrating the diverse approach insurers take to meet the evolving needs of their members.

Leading Australian health insurers provide benefits beyond core hospital and extras coverage. Bupa, for example, features wellness programs, health coaching, and discounts on fitness memberships and preventive screenings. Their hospital cover extends to choice of doctor and access to private rooms (where available), which appeals to those valuing privacy and personal attention during inpatient stays. This blend of clinical care and everyday wellness resources adds significant ongoing value for policyholders.

Medibank goes further by integrating digital and telehealth services into its offerings. Members benefit from 24/7 nursing helplines, virtual mental health consultations, and digital health tracking. These services are particularly attractive for tech-savvy Australians or those in rural and regional settings where access to in-person services may be limited. By bringing healthcare support into the home, Medibank is adapting to modern lifestyles and encouraging proactive self-care.

nib’s Family Health Insurance targets families with versatile options such as gap-free dental for kids at select partners, high annual limits on extras, and access to online health support tools. This focus on included benefits for children and young adults addresses a key concern for many Australian households—the desire to minimise ongoing healthcare costs while ensuring timely treatment for the entire family.

All three insurers provide access to member-only deals, elective surgery with reduced waiting times, and streamlined claims processes. In an era where efficiency and affordability are critical, these practical features improve the day-to-day experience of managing personal health. In the pages ahead, we will explore how value-added benefits can impact overall well-being and future planning for individuals and families alike.

The price of private health insurance in Australia varies based on several factors: coverage level, age, location, and chosen excess. For a basic hospital and extras plan, weekly premiums typically start from around $22–$27. However, comprehensive policies with extensive extras or fewer exclusions command a higher price. Many Australians offset these expenses by tailoring coverage to predicted usage, raising their excess, or opting for policies aligned with their life stages.

Savings come into play through several government mechanisms. The private health insurance rebate reduces out-of-pocket premium costs for many Australians, and the Medicare Levy Surcharge encourages higher-income earners to hold private hospital cover. These incentives not only lessen the apparent financial burden but also reward early policy adoption. It’s no coincidence that younger Australians commonly select introductory products from Bupa, nib, or Medibank to lock in lower rates and avoid the extra Lifetime Health Cover loading later on.

Another key savings strategy is the ability to switch providers without losing waiting period credits, provided there’s no gap in comparable cover. This flexibility allows policyholders to routinely assess products and move to better-value plans as their needs shift—something major insurers support through streamlined switching processes and online tools. Comparing features, limits, and value-added extras each year becomes an essential habit for budget-conscious Australians.

Some Australians find value in “junk” or basic cover primarily to avoid tax penalties but are increasingly savvy about avoiding underinsurance. The most astute use their policy for health protection rather than simply cost avoidance. In practice, this means seeking out hospital cover that matches personal risk factors and extras policies that align with anticipated usage, rather than chasing the lowest premium. In upcoming sections, we’ll evaluate how these strategies influence future well-being and financial peace of mind.

Private health insurance creates a pathway to ongoing wellness by enabling timely access to preventive services and cutting-edge treatments. Policies from Bupa, Medibank, and nib often include built-in health tracking, proactive screening programs, and educational resources—encouraging Australians to engage actively with their health before issues escalate. Over time, this proactive engagement translates to fewer hospital admissions, improved quality of life, and greater resilience to future medical uncertainties.

Family planning and intergenerational support are also enhanced through comprehensive health insurance. For instance, parents use family extras plans from nib or Bupa to fund children’s orthodontics, optical care, or speech therapy—services that can be difficult to afford out-of-pocket. Early intervention provides long-term benefits not only for individual children but for the wider community, as healthier families contribute to sustained public health outcomes.

Mental health—a rising priority in Australia’s healthcare landscape—is increasingly supported through insurance. Medibank and Bupa offer psychological support and counselling as extras, sometimes with minimal or no wait times. In a country where almost half the population faces mental health challenges in their lifetime, access to affordable, timely care is a powerful element in protecting future well-being and enabling individuals to flourish across all life stages.

Ultimately, health insurance in Australia operates as both a shield and a springboard. It shields against financial stress from healthcare events and also empowers policyholders to invest in their health and happiness for the long term. While every situation is unique, choosing the right policy today lays the groundwork for a healthier, more secure tomorrow—a promise that continues to evolve with each innovation from Australia’s leading health insurers.